Charitable donations aren't just favorable to various in need; they can also substantially lower your tax burden. By making a donation to a eligible charity, you can deduct a portion of your revenue on your tax return. This means more money in your pocket and the satisfaction of knowing you've made a positive impact. To enhance your tax savings, carefully research charities that match with your values and evaluate contributing during the year when you're in a higher tax bracket.

- Keep in mind to retain accurate records of your donations, encompassing donation receipts and details about the charity.

- Speak with a tax advisor for particular advice on maximizing your charitable contributions and their impact on your taxes.

||

Giving back to your society is a deeply rewarding experience. It's also an opportunity to lower your tax burden. By making charitable donations to eligible organizations, you can deduct those expenses from your income, potentially leading to a substantial reduction in your overall tax liability.

Explore working with a financial advisor to determine the best strategies for maximizing your charitable contributions. They can advise you on the kinds of nonprofits that qualify for tax benefits and help you organize your giving in a way that maximizes both your contribution and your tax situation.

Strategic Giving: Donation Strategies for Tax Benefits

For those seeking to optimize their charitable contributions while also utilizing tax benefits, smart philanthropy offers a strategic approach. By carefully structuring donations and understanding the relevant legislation, individuals can decrease their tax liability while contributing to causes they are passionate for. A key element of smart philanthropy involves thorough investigation into various donation methods, such as direct giving, each offering unique perks and tax implications.

- Evaluate the establishment of a charitable trust to furnish ongoing support to your chosen causes, potentially leading to significant savings.

- Utilize donor-advised funds (DAFs) for flexible giving and potential advantages, allowing you to invest your contributions over time.

- Engage with a qualified tax expert to develop a personalized philanthropy plan that maximizes both your social contribution and your overall savings.

Tap into Tax Advantages with Charitable Contributions

Charitable contributions can yield significant tax benefits. When you contribute to qualified organizations, you may be able to reduce your taxable income, thereby saving your overall tax liability. The extent of the deduction depends on several factors, including the type of contribution and your tax bracket.

It's crucial to discuss a qualified tax advisor to determine the best charitable giving strategy for your personal situation. They can guide you in maximizing your tax benefits while contributing to causes you care about.

Explore these key points when planning charitable contributions:

- Select qualified organizations that align with your beliefs

- Keep accurate records of all donations

- Research different types of charitable contributions, such as cash, assets, or volunteer time

By implementing informed decisions about your charitable giving, you can build a meaningful impact while leveraging valuable tax advantages.

The Ripple Effect: How Tax-Deductible Donations Make a Difference

Charitable giving can be incredibly rewarding, but did you know that your generosity can also offer tangible tax perks? Tax-deductible donations provide an amazing opportunity to impact causes you care about while optimizing your tax burden. By donating to eligible charities, you can reduce your tax liability, effectively multiplying the impact of your donation for tax saving gift.

- Explore donating to organizations that connect with your passions, whether it's supporting education or helping animals.

- Research different charities and their missions to ensure your donation goes towards a cause that makes a difference.

- Keep meticulous records to ensure proper filing for tax purposes.

Tax-deductible donations provide a win-win situation - you can support those in need while also optimizing your resources.

Contribute to a Cause, Lower Your Tax Liability: Give Today

Every donation, big or small, can make a real difference in the lives of others. And, your generosity may lower your tax burden for the year. By contributing to worthy causes you not only help create positive change, but also benefit financially. Together with us in making a difference today!

- Check out our online donation page to learn more about how your contribution can make an impact.

- Every dollar counts

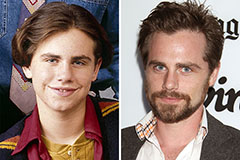

Rider Strong Then & Now!

Rider Strong Then & Now! Scott Baio Then & Now!

Scott Baio Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Barry Watson Then & Now!

Barry Watson Then & Now! Danielle Fishel Then & Now!

Danielle Fishel Then & Now!